First, I don't have a fancy program. In 2004, I made this up on my own in Microsoft Excel spreadsheet program - to mimic a checkbook register. So, I have kept to it and like it because it works for me. You may not like it...it's just your own decision what you use. To prove it, here is a glimpse of my spreadsheet from the last 8 years!

I used to work {yes, at a real job} and used Excel often, so I was familiar enough with it that I knew how to set up a checkbook register on Excel to help keep track of everything. I also do almost ALL my banking online and rarely write checks anymore, too. This is by far the easiest and most wonderful thing you can do, since your credit union or bank can electronically or manually send checks and you don't have to deal with stamps, etc. You can even have it set up to pay at a certain date...so you don't forget about it or automatically pay a recurring payment!

I'm going to interject a moment of my own advice {since both my FIL and hubby work for credit unions} but I sincerely advise that you look into getting your checking/saving accounts at a credit union. They are by far the best way to go. They have better rates - and let's face it, they are NON-profit organizations looking to get you the best deals! Here is an article if you don't believe me. Enough said!

|

| Even Suze Orman knows it's best! |

OK,with that said....I started with making a check register out of it like this on top:

Then, I just type in all the transactions as they go...and go online on a daily {or every other day} basis to see what has come and gone in our checking account. I HIGHLY recommend making use of writing any comment you can - sometimes I go back and cannot figure why I spent $300 on Paypal only to be happy I made a comment! I also use this spreadsheet at the beginning of each year to then make up the next year's budget. When doing this, I also set up {I know this is CRAZY} about TEN savings accounts {the max allowed}, plus more in my own "business" checking account. I have each categorized like below:

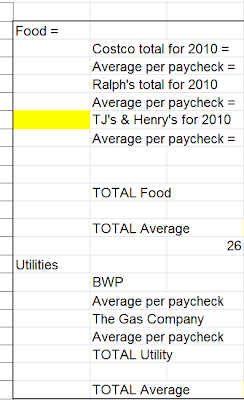

When my hubby gets paid, I distribute according to what I've budgeted into each of these accounts. Then, when I have to pay for something under the categories, I just transfer it over when I'm checking my balance. I have figured out HOW MUCH to pull out each paycheck based on going through my check book "register" from the year before. Here is an example of food and utilities:

It's tedious, but at the beginning of the year, I take EVERY category I can think of {go down and look at EVERY place you purchase things from - mortgage, eating out, insurance, etc.}.

Figure out how much even the little things are, any stores you shop at regularly, and divide that by the number of paychecks you/your spouse receives to figure out your budget. Then, each pay period, take out THAT amount and put it in the savings account {similar to the old envelope method} - except that you will EARN interest and even if it's more than you need for this month. For instance, if you average your yearly utility bill and it's $1200 for the whole year {even though some months it's $200 and other months it's $50}, you would still take out $50 per pay period {if you get paid twice a month}...the "extra" will be there for the months of the year that you have a larger utility bill {for us it's late summer}. You see? As the years went by, I learned to color code things in my register to make it easier to spot certain line items {groceries, transfers, entertainment, medical misc., etc.}.

Another great website and app. for your smart phone is Mint.com. It actually sends you an email of all your expenses you made for the week and tells you how much you spent in different categories. It's super neat! It will send you notices like: "In the past 30 days you spent $300 on eyewear and normally you spend $10" It will alert you when it thinks you should know you are spending too much or what your average is.

So, this is it! I hope you didn't get overwhelmed by my system! It's not perfect, but it works for me! Do you have a system for budgeting?

*Welcome, if you are a visitor and can't find the comment box, just click on the post you'd like to comment on {it's in pink below the date} and the comment box will appear at the bottom of the page when you scroll down!

Also, participating here:

House of Grace

Like what you see here? Consider becoming a follower or subscribe via email!

Join me on Facebook - where we interact and have lots of great fun. You can also see behind the scenes pictures and fun stuff I do on my Instagram!

There are some products that are linked to my Amazon affiliate link.